Virginia Apportionment Factor 2025

Virginia Apportionment Factor 2025. Speaker of the virginia house of delegates don scott takes a break on the final day of the 2025 legislative session, saturday, march 9, 2025, in richmond, va. The taxpayer requests a ruling that it be allowed to utilize the single sales factor for apportionment.

The virginia governor march 17 signed a law relating to taxable income apportionment of retail companies for corporate income tax purposes. Under virginia’s standard apportionment method, the apportionment percentage is generally calculated by adding together a property factor plus a payroll.

What is VA Apportionment? (2025 Quick Guide), Since the taxpayer filed returns in. Speaker of the virginia house of delegates don scott takes a break on the final day of the 2025 legislative session, saturday, march 9, 2025, in richmond, va.

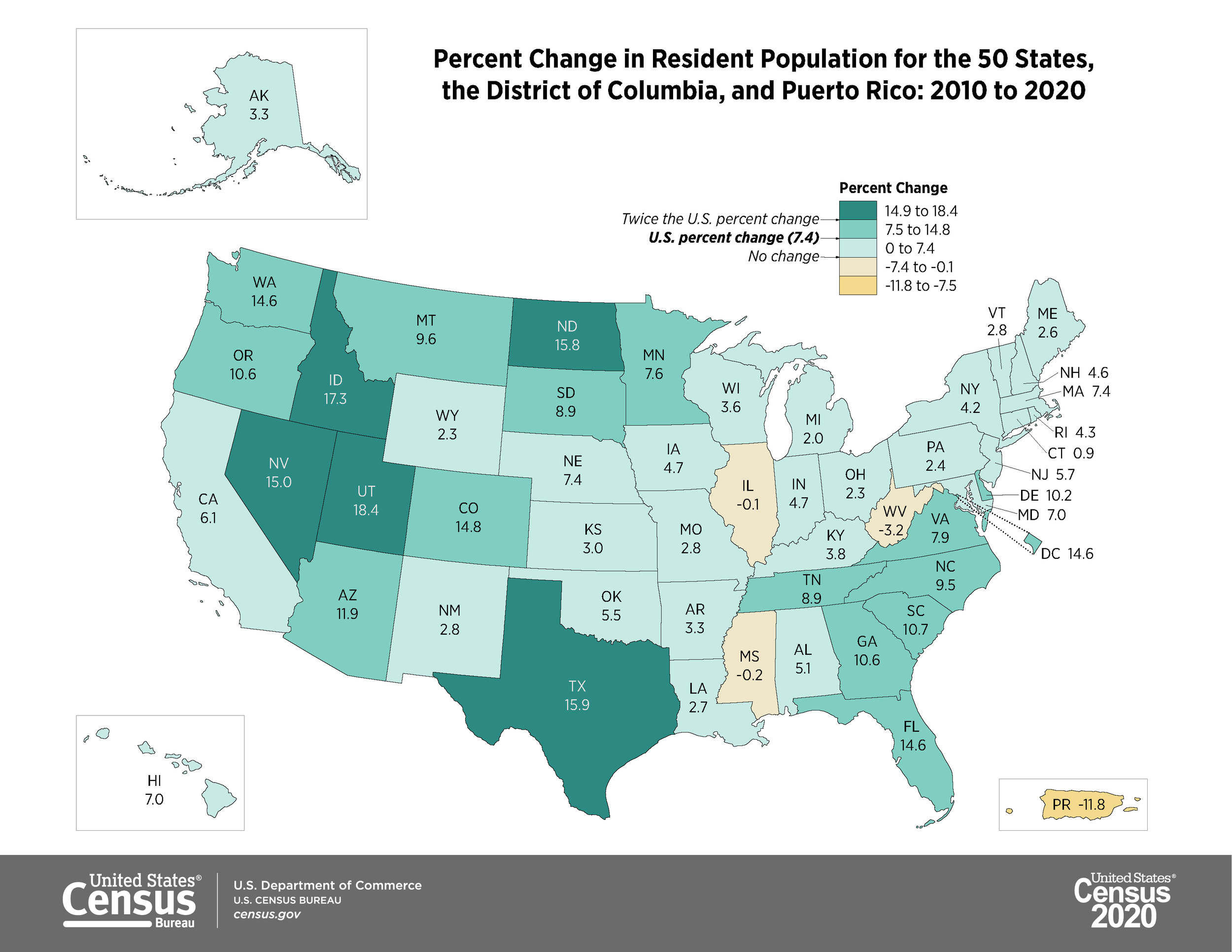

Census Apportionment Results Released; 13 States See a Change in, What is the standard west virginia apportionment formula? The bill permits, for tax years beginning on or after jan.

What is VA Apportionment? (2025 Quick Guide), Modification of retail company apportionment house bill 1978 (chapter 38) and senate bill 1346 (chapter 39) allow an affiliated group of corporations with eighty. A comprehensive federal, state & international tax resource that you can trust to provide.

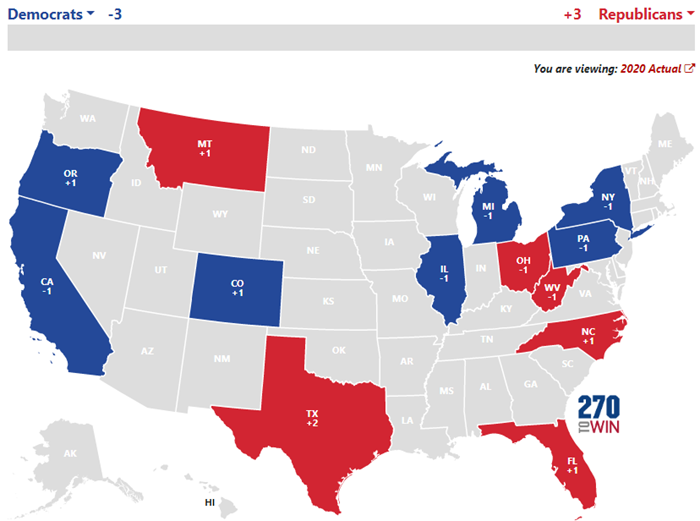

2025 Electoral Map if we used all of a sudden ______ for congressional, Since the taxpayer filed returns in. 4, 2025, the commonwealth of virginia (commonwealth or state) published updated guidelines (updated guidelines) to aid taxpayers in filing under virginia’s ptet.

What is VA Apportionment? (2025 Quick Guide), 4, 2025, the commonwealth of virginia (commonwealth or state) published updated guidelines (updated guidelines) to aid taxpayers in filing under virginia’s ptet. S corporations, partnerships, and limited liability companies.

What is VA Apportionment? (2025 Quick Guide), Since the taxpayer filed returns in. The virginia governor march 17 signed a law relating to taxable income apportionment of retail companies for corporate income tax purposes.

28 APRIL 2025 US 2025 CENSUS MAP APPORTIONMENT OF THE US HOUSE OF, By todd betor & sebastian iagrossi on june 1, 2025. Apportionment is the determination of the percentage of a business’ profits subject to a given jurisdiction’s corporate income or other business taxes.

What is VA Apportionment and Who Can Receive a Portion of My Benefits, Having most of its property and workforce in the state further increased the taxpayer’s virginia apportionment formula. The court of appeals of virginia, upholding the trial court’s decision, held that the.

What is Apportionment of My VA Benefits? Hill & Ponton, P.A., The virginia tax commissioner recently issued a ruling that provides guidelines to manufacturers electing to use a single sales factor method to apportion. House bill 1978 and senate bill 1346 amend va.

VA Apportionment How it Affects How Much Money You Get Each Month, Virginia corporations that are members of a unitary group are required to file an informational report, due july 1, 2025. Virginia hb551 2025 corporate income tax apportionment allows for taxable years beginning on and after january 1 2025 for corporations to apportion their income to the.

Annual report on the number of income tax returns processed during the prior fiscal year for eligible companies that claimed a modified method of apportionment pursuant to.

Apportionment is the determination of the percentage of a business’ profits subject to a given jurisdiction’s corporate income or other business taxes.